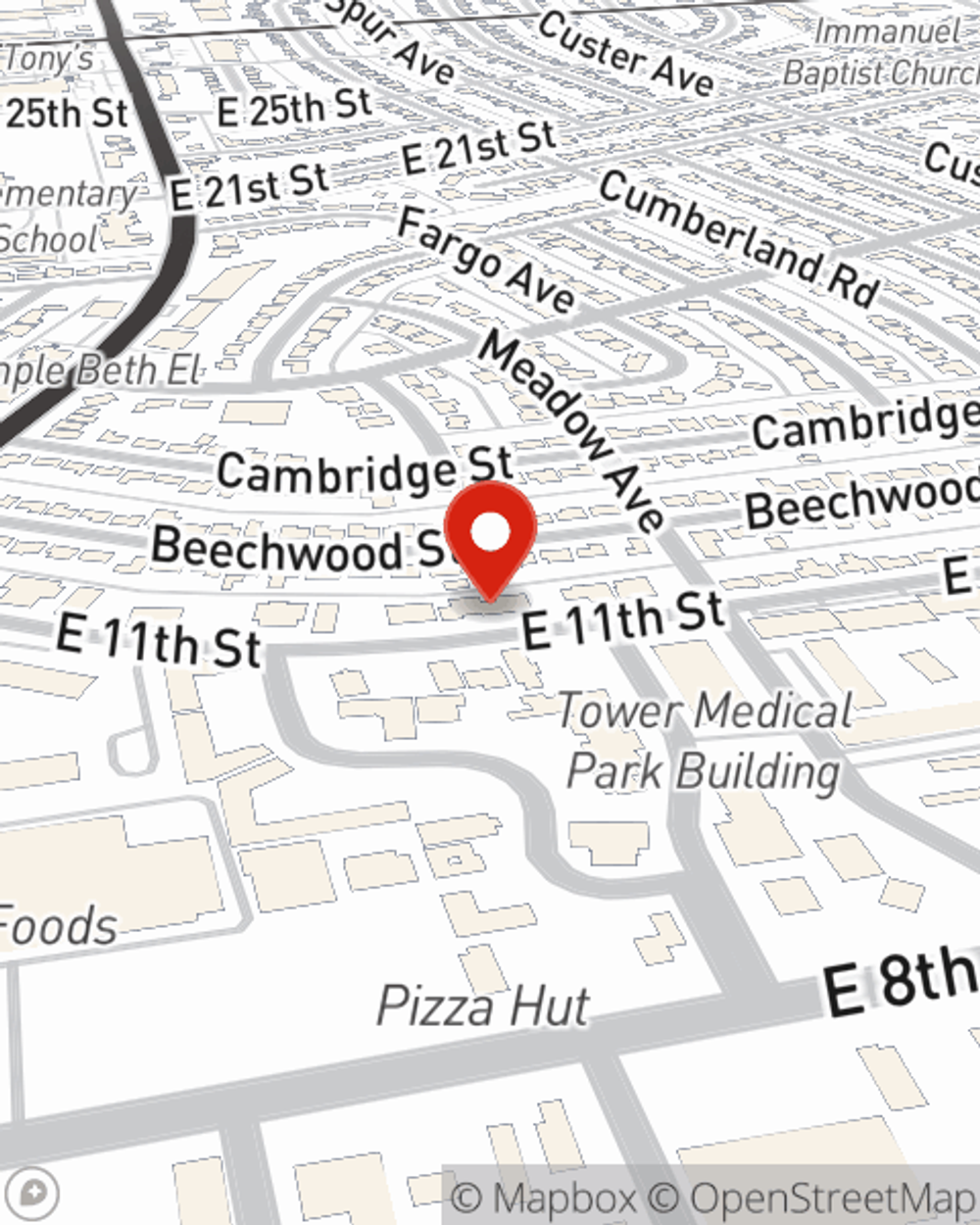

Homeowners Insurance in and around Odessa

Protect what's important from the unanticipated.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

- Odessa

- Midland

- Andrews

- Snyder

- Pecos

- Fort Stockton

- San Angelo

- Monahans

- Van Horn

- Big Spring

- Seminole

- Lamesa

- Sonora

- Alpine

- Presidio

- Sanderson

- EL Paso

- Lubbock

- Brownfield

With State Farm's Insurance, You Are Home

Being at home is great, but being at home with coverage from State Farm is the icing on the cake. This outstanding coverage is more than just precautionary in case of damage from ice storm or windstorm. It also can cover you in certain legal cases, such as someone falling in your home and holding you responsible. If you have the right coverage, your insurance may cover these costs.

Protect what's important from the unanticipated.

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Safeguard Your Greatest Asset

With this terrific coverage, no wonder more homeowners choose State Farm as their home insurance company over any other insurer. Agent Crystal Johnson would love to help you get the policy information you need, just reach out to them to get started.

For great protection for your home and your momentos, check out the coverage options with State Farm. And if you're ready to see how you can save on a home insurance policy, reach out to State Farm agent Crystal Johnson's office today.

Have More Questions About Homeowners Insurance?

Call Crystal at (432) 362-9722 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

What is an impact-resistant roof?

What is an impact-resistant roof?

Weather such as hail, high winds, snow and ice and even nearby wildfires can weaken or destroy your roof system. Impact-resistant shingles can help.

Backyard playground and trampoline safety tips

Backyard playground and trampoline safety tips

These outdoor playground and backyard trampoline safety tips can help keep everyone safe. Don’t take unnecessary risks.

Crystal Johnson

State Farm® Insurance AgentSimple Insights®

What is an impact-resistant roof?

What is an impact-resistant roof?

Weather such as hail, high winds, snow and ice and even nearby wildfires can weaken or destroy your roof system. Impact-resistant shingles can help.

Backyard playground and trampoline safety tips

Backyard playground and trampoline safety tips

These outdoor playground and backyard trampoline safety tips can help keep everyone safe. Don’t take unnecessary risks.